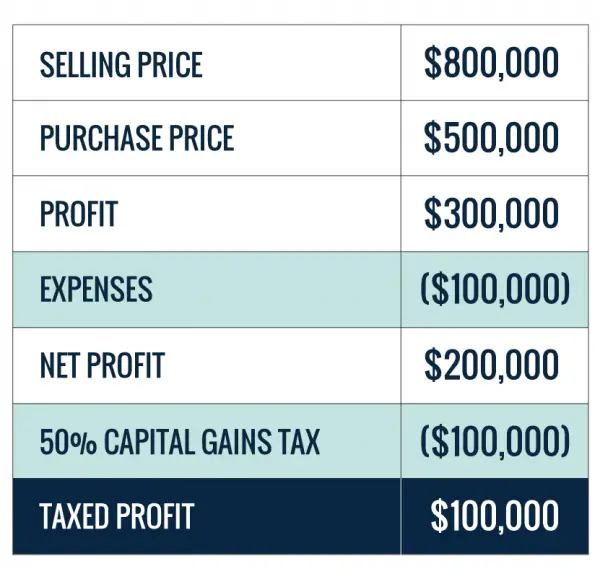

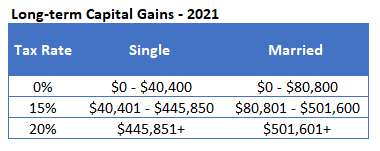

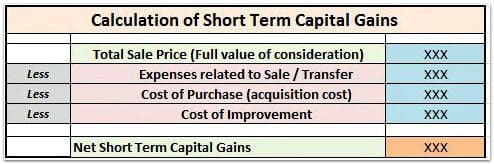

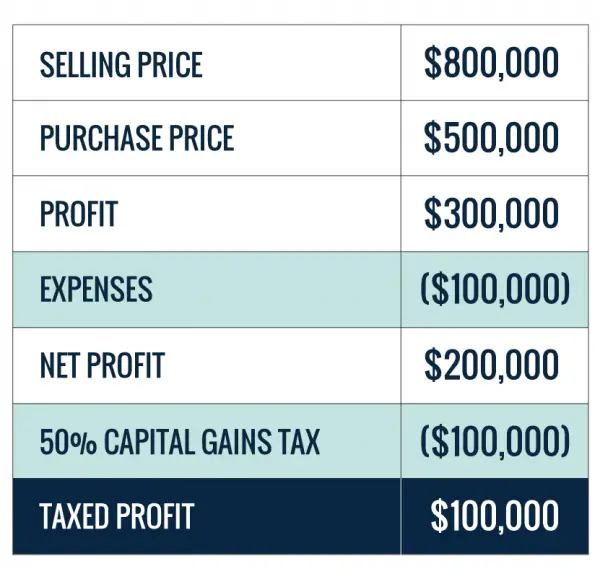

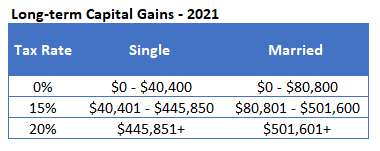

on how much profit they exclude from taxes. First, you must identify the new property you want to buy within 45 days.9 (That means youll need to shop for another property ASAP.) Answer some questions to get offerswith no impact to your credit score. If you must sell before two years, you may still be eligible for a portion of the exclusion, depending on the circumstances. With tax rates on long-term gains likely being more favorable than short-term gains, monitoring how long youve held a position in an asset could be beneficial to lowering your tax bill. That means weve vetted them, and we trust them to put your needs first. Its important to note that gains from stocks, bonds and real estate are all eligible. Say you and your spouse bought a house 10 years ago for $300,000 in an up-and-coming part of town. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. This changes your capital gains significantly. Tax-loss harvesting is selling securities at a loss to offset the amount of capital gains tax owed on other investments. More details on this type of holding and its taxation are available in IRS Publication 544. With this new math, your net capital gains on a house you paid $200,000 for is only $265,000. Generally, the tax consequences are the same whether or not the home office deduction was previously claimed. so you can trust that were putting your interests first. Thatll lower your tax burden some, but the really cool way to avoid capital gains taxes is doing a 1031 exchange. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. The IRS warns that not all social media tax advice should be trusted. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. WebReducing the basis increases your gain on the sale. WebHarman Real Estate Academy.  If you used the simplified method to claim home office deductions on your return, you don't have to worry about this. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules. Published 22 March 23. By Joelle Spear, CFP And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes. Here are important capital gains tax rules to keep in mind. A capital gains distribution does not impact the fund's total return. Theres one caveat: After you sell investments, you must wait at least 30 days before purchasing similar assets. In 2023, individual filers wont pay any capital gains tax if their total taxable income is $44,625 or less. How much should you contribute to your 401(k)? Thats $125,000. WebReducing the basis increases your gain on the sale. Replaced the windows? Published 4 April 23. Capital gains are the profits that are realized by selling an investment, such as stocks, bonds, or real estate. All Rights Reserved. Understanding this distinction and factoring it into investment strategy is particularly important for day traders and others who take advantage of the greater ease of trading in the market online. Second, you must close the sale within 180 days.10 Whoa, thats a lot of pressureespecially if youre the type who takes three hours to make a simple decision like which movie to watch. However, when you sell your primary home, the first $250,000 is exempt from capital gains tax. The state of Florida does not have a capital gains tax, regardless if you are a state Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long youve held the asset. Ugh, the IRS and their numbered forms. However, if you are in the 39.6% income tax bracket, you will pay a 20% capital gains rate on your long-term capital gains. Well, you could. What's the difference between long-term and short-term capital gains? Long-term capital gains tax rate

If you used the simplified method to claim home office deductions on your return, you don't have to worry about this. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules. Published 22 March 23. By Joelle Spear, CFP And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes. Here are important capital gains tax rules to keep in mind. A capital gains distribution does not impact the fund's total return. Theres one caveat: After you sell investments, you must wait at least 30 days before purchasing similar assets. In 2023, individual filers wont pay any capital gains tax if their total taxable income is $44,625 or less. How much should you contribute to your 401(k)? Thats $125,000. WebReducing the basis increases your gain on the sale. Replaced the windows? Published 4 April 23. Capital gains are the profits that are realized by selling an investment, such as stocks, bonds, or real estate. All Rights Reserved. Understanding this distinction and factoring it into investment strategy is particularly important for day traders and others who take advantage of the greater ease of trading in the market online. Second, you must close the sale within 180 days.10 Whoa, thats a lot of pressureespecially if youre the type who takes three hours to make a simple decision like which movie to watch. However, when you sell your primary home, the first $250,000 is exempt from capital gains tax. The state of Florida does not have a capital gains tax, regardless if you are a state Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long youve held the asset. Ugh, the IRS and their numbered forms. However, if you are in the 39.6% income tax bracket, you will pay a 20% capital gains rate on your long-term capital gains. Well, you could. What's the difference between long-term and short-term capital gains? Long-term capital gains tax rate  Just eight states have no income tax Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. Current income tax brackets for are: 10%, 12%, 22%, 24%, 32%, 35% and 37%. In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly. Other strategies include leveraging retirement accounts to delay paying capital gains taxes while maximizing growth. The answer is maybe. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. You have simply moved the unwanted mud from an inconvenient position to a more convenient position for you. You also qualify if a primary resident of your home died, got divorced or legally separated, gave birth to twins or other multiples, lost their job, or could no longer afford the home due to a change in employment. You can learn more about the standards we follow in producing accurate, unbiased content in our. The first is for so-called unrecaptured Section 1250 gain, which applies if you took depreciation deductions in the past for the office or rental space. The debtor will be taxed on any remaining forgiven debt at ordinary income tax rates up to 37%. All property owners should be familiar with the capital gains tax on real estate. However, she cannot exclude the part of the gain equal to the depreciation she claimed for renting the house. In the case

Just eight states have no income tax Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. Current income tax brackets for are: 10%, 12%, 22%, 24%, 32%, 35% and 37%. In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly. Other strategies include leveraging retirement accounts to delay paying capital gains taxes while maximizing growth. The answer is maybe. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. You have simply moved the unwanted mud from an inconvenient position to a more convenient position for you. You also qualify if a primary resident of your home died, got divorced or legally separated, gave birth to twins or other multiples, lost their job, or could no longer afford the home due to a change in employment. You can learn more about the standards we follow in producing accurate, unbiased content in our. The first is for so-called unrecaptured Section 1250 gain, which applies if you took depreciation deductions in the past for the office or rental space. The debtor will be taxed on any remaining forgiven debt at ordinary income tax rates up to 37%. All property owners should be familiar with the capital gains tax on real estate. However, she cannot exclude the part of the gain equal to the depreciation she claimed for renting the house. In the case  But dont count your profits too quickly because Uncle Sam wants his cut of your gains, too. 12 Best For Sale By Owner Websites in 2023, How To List On MLS For Sale By Owner In 2023, 13 Best Companies That Buy Houses For Cash (2023), Flat Fee MLS: Everything You Need to Know, Americas 10 Best Discount Real Estate Brokers and Companies (2023). For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain. But what is the capital gains tax? In this analogy the mud represents the capital gains on which CGT is ordinarily payable and the towel represents shares in your new company. Instead of paying $110, youll pay $105, and see $595 worth of net profit instead.

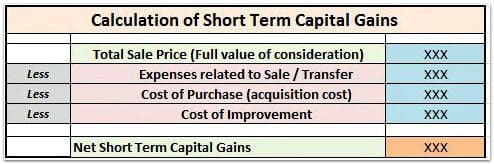

But dont count your profits too quickly because Uncle Sam wants his cut of your gains, too. 12 Best For Sale By Owner Websites in 2023, How To List On MLS For Sale By Owner In 2023, 13 Best Companies That Buy Houses For Cash (2023), Flat Fee MLS: Everything You Need to Know, Americas 10 Best Discount Real Estate Brokers and Companies (2023). For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain. But what is the capital gains tax? In this analogy the mud represents the capital gains on which CGT is ordinarily payable and the towel represents shares in your new company. Instead of paying $110, youll pay $105, and see $595 worth of net profit instead.  If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing These reductions of capital gain are instead added to your homes cost basis to decrease the amount youll owe in taxes when you sell. By knowing how capital gains tax works, you can make informed decisions and maximize your profits. Moreover, capital losses can sometimes be deducted from one's total tax bill. Should you accept an early retirement offer? The income thresholds depend on the filers status (individual, married filing jointly, etc.) So the key is to plan ahead! By exploring your options, you can make smart money decisions. Note that the unrecaptured Section 1250 gain can also apply to the sale of your main residence if you took depreciation deductions for it in the past, such as from a conversion from a rental home to your primary home or if you had an office in the home. A capital loss occurs when you sell a property for less money than you originally purchased it for. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Short- and long-term capital gains are taxed differently. Capital gains taxes are lower than ordinary income taxes, providing an advantage to investors over wage workers. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. The stupid tax doesnt have tax brackets. The tax rates for capital gains are listed below. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. President Bidens new economic plan would eliminate a tax break for many real-estate owners that has enabled them to defer paying capital gains on property sales. Robo-advisors often employ tax strategies that you may miss or be unaware of (such as tax-loss harvesting). 13 Tax Breaks for Homeowners and Home Buyers. Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. WebNon-resident capital gains tax (CGT) on UK real estate: the new regime The legislation for the new regime for taxing non-residents gains on UK commercial real estate has now Future US, Inc. Full 7th Floor, 130 West 42nd Street, A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Equity is current value minus liabilities. The part of the gain added due to depreciation may be taxed at a 25% rate. The tax rules applicable to short sales differ depending on whether the debt is recourse or nonrecourse. Most states simply tax your investment income at the same rate that they already charge for earned income, but some tax them differently (and some states have no income tax at all.). Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This tax on capital gains and other investment income kicks in if your income exceeds a set limit.

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing These reductions of capital gain are instead added to your homes cost basis to decrease the amount youll owe in taxes when you sell. By knowing how capital gains tax works, you can make informed decisions and maximize your profits. Moreover, capital losses can sometimes be deducted from one's total tax bill. Should you accept an early retirement offer? The income thresholds depend on the filers status (individual, married filing jointly, etc.) So the key is to plan ahead! By exploring your options, you can make smart money decisions. Note that the unrecaptured Section 1250 gain can also apply to the sale of your main residence if you took depreciation deductions for it in the past, such as from a conversion from a rental home to your primary home or if you had an office in the home. A capital loss occurs when you sell a property for less money than you originally purchased it for. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Short- and long-term capital gains are taxed differently. Capital gains taxes are lower than ordinary income taxes, providing an advantage to investors over wage workers. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. The stupid tax doesnt have tax brackets. The tax rates for capital gains are listed below. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. President Bidens new economic plan would eliminate a tax break for many real-estate owners that has enabled them to defer paying capital gains on property sales. Robo-advisors often employ tax strategies that you may miss or be unaware of (such as tax-loss harvesting). 13 Tax Breaks for Homeowners and Home Buyers. Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. WebNon-resident capital gains tax (CGT) on UK real estate: the new regime The legislation for the new regime for taxing non-residents gains on UK commercial real estate has now Future US, Inc. Full 7th Floor, 130 West 42nd Street, A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Equity is current value minus liabilities. The part of the gain added due to depreciation may be taxed at a 25% rate. The tax rules applicable to short sales differ depending on whether the debt is recourse or nonrecourse. Most states simply tax your investment income at the same rate that they already charge for earned income, but some tax them differently (and some states have no income tax at all.). Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This tax on capital gains and other investment income kicks in if your income exceeds a set limit.  Find a personal loan in 2 minutes or less. Some financially distressed homeowners might be considering a short sale of their home. While this may not be an option for everyone, it can provide huge tax benefits. At a 15% tax rate, you only owe $2,250 a significant drop from the original estimation of $7,400. In this case, the waived debt is included in the amount realized for calculating capital gain or loss on the short sale. The situation or operations eventually realised differ from those described in the application. For most taxpayers, the long-term capital gains tax rate is 15%, while taxpayers in the highest tax bracket may pay a rate of 20%. But if she sold the house, even using the $250,000 tax exemption, I imagine a significant amount would go to pay capital gains tax. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Find a personal loan in 2 minutes or less. Some financially distressed homeowners might be considering a short sale of their home. While this may not be an option for everyone, it can provide huge tax benefits. At a 15% tax rate, you only owe $2,250 a significant drop from the original estimation of $7,400. In this case, the waived debt is included in the amount realized for calculating capital gain or loss on the short sale. The situation or operations eventually realised differ from those described in the application. For most taxpayers, the long-term capital gains tax rate is 15%, while taxpayers in the highest tax bracket may pay a rate of 20%. But if she sold the house, even using the $250,000 tax exemption, I imagine a significant amount would go to pay capital gains tax. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.  That means your gain on the sale is $340,000 ($600,000 $260,000). The capital gains tax is levied on any profits you make from selling an investment. Long-term capital gains tax rate . But you couldnt sell a home and invest the money in mutual funds or some other investment like cryptocurrency (crypto is never a good idea anyway). Instead, if you hold on to the stock until the following December and then sell it, at which point it has earned $700, its a long-term capital gain. Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. A net capital gain may be subject to a lower tax rate than the ordinary income tax rate. There are a few ways to avoid the capital gains tax, but the big one is to stay put! Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. The property needs to be your primary residence for 2 years from the last 5 years of its ownership. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Utah's Premiere Real Estate Academy! Last updated 9 March 23. The following are some assets that are and are not eligible. WebShort-term capital gain tax rates . A tax advisor may be available through your personal financial advisor, if you have one. SmartReads About Press His work has been cited by CNBC, the Washington Post, The New York Times and more. Can you qualify for the full $250,000/$500,000 capital gains tax exclusion? ELPs are experienced agents who will serve you with excellence. The capital gains tax can apply to any asset that increases in value. Jeff earns $80,000 per year, which puts him in the enormousincome group ($40,001to $441,500 for individuals and $80,001to $496,600 for those married filing jointly) that qualifies for long-term capital gains tax rate of15%. So, $525,000 is a big pile of money, but since you only owed $93,000 on your home, you actually If a latent capital gain is being inherited, the purchase price for the shares being acquired should be adjusted to take into account the latent tax charge (purchase Here's an explanation for how we make money Biden Wants a Wealth Tax: Should Billionaires Pay More. Its true thanks to a century-old tax loophole called the 1031 exchange. The towel isnt white any more is it? And he could hit you with a big bill! Gains from the sale of vacation homes don't qualify for the $250,000/$500,000 capital gains tax exclusion that And what you pay depends on your total income and how long youve held onto those assets. If youve realized a profit on an investment in a taxable account, then youve earned a capital gain and youll have to pay tax on it. By Kelley R. Taylor While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Remember, short-term gains occur on assets held for one year or less. Heres how it works. What are Bonds? Bonds trade Medicare Checklist: Avoid Costly Enrollment Mistakes, Want to Reduce Investment Taxes? A wash sale is a transaction where an investor sells an asset to realize tax advantages and purchases an identical investment soon after, often at a lower price. Moreover, if the capital gains put your income over the threshold for the 15% capital gains rate, the excess will be taxed at the higher 20% rate. WebThe tax rate is the same as your regular income tax rate, which can range from 10% to 37% depending on your income level. Investing involves risk including the potential loss of principal. The capital gains tax is what you pay on an assets appreciation during the time that you owned it. If youre buying and selling assets, you probably know you have to pay capital gains taxes. If youre in the 22 percent tax bracket, you have to pay the IRS $110 of your $500 capital gains. Many homeowners are aware of the general tax rule for home sales if you have owned and lived in your main home for at least two out of the five years leading up to the sale, up to $250,000 ($500,000 for joint filers) of your gain is tax-free. For example, if you are in the 10% income tax bracket, you will pay a 0% capital gains rate on your long-term capital gains. You could owe long-term capital gains after selling assets that you owned longer than one year. If you buy $5,000 worth of stock in May and sell it in December of the same year for $5,500, youve made a short-term capital gain of $500. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. If the home you sold was your primary residence for at least two of the last five years, you dont have to pay capital gains taxes on your profit up to a certain amount. In simple words, paying taxes on any profit made from your homes sale may be required. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Capital Gains Tax on Real Estate Selling your home or a rental property at a gain? and some states have no income tax at all. WebIf a latent gain exists, it is because you have insufficient equity to convert into shares in order to offset all of your capital gains at the point of incorporation. The income thresholds depend on the filers status (individual, married filing jointly, etc.). It depends. The tax rate is 0%, 15%, or 20% depending on your filing status and taxable income. It's known as unrecaptured Section 1250 gain, the number of its own federal tax code section. So youve made some money investing or really any asset trade where you came out ahead. For example, say you sell a vacation home that you owned since 2010 for $775,000, and you have a tax basis of $610,000. process and giving people confidence in which actions to take next. Not all investments are eligible for the lower capital gains rates. Long-Term Capital Gains Tax: It applies to a home owned for more than one year before it is sold. Bankrate follows a strict editorial policy, The 2017 Tax Cuts and Jobs Act created Opportunity Zones areas around the country that have been identified as After the $250,000 tax exemption, you only need to pay taxes on $15,000. For example, if your capital losses in a given year are $4,000 and you had no capital gains, you can deduct $3,000 from your regular income. How to Deduct Stock Losses From Your Tax Bill, Income Tax vs. Capital Gains Tax: Differences, Short-Term Capital Gains: Definition, Calculation, and Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates, Unrecaptured Section 1250 Gain: What It Is, How It Works, Example, Tax-Loss Harvesting: Definition and Example, What Is Schedule D: Capital Gains and Losses? 409: Capital Gains and Losses.". Long-term (more than one year) capital gains are taxed based on your income. Your heart sinks. Homeowners should consult with a qualified tax professional to ensure they are taking advantage of all available tax breaks. If youre looking to avoid paying capital gains tax, here are some strategies you can consider: Understanding capital gains tax on real estate is crucial for anyone who is planning to sell their home. However, there is a scenario where CGT would not fall due on disposal of the company shares, i.e. Indirect investments can include private equity, real estate and infrastructure fund investments, as well as club deals and joint ventures. Published 4 April 23. Drop and Swap 1031 Exchange: A Guide for Real Estate Investors. But if she sold the house, even using the $250,000 tax exemption, I imagine a significant amount would go to pay capital gains tax. Lets look at an example. You can reduce capital gains tax on your home by living in it for more than two years and keeping the receipts for any home improvements you make. If you sell a main home that you previously used as a vacation home, some or all of the gain is ineligible for the home-sale exclusion. This enrollment checklist flags important info you need to know. A capital loss is the opposite of a capital gain. Again, if you make a profit on the sale of any asset, its considered a capital gain. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Weve maintained this reputation for over four decades by demystifying the financial decision-making These include state and local transfer taxes, recording fees, and real estate agent commissions. Latent gains occur when equity in your business is less than your capital gains. And thats a relief since that check you get at closing could be much bigger than whats considered profitespecially if youve been working hard to pay off your house. If you sell an asset for more than you paid for it, thats a capital gain. For instance, maybe you're thinking of selling your home or residential rental property that you own. Bankrate has answers. Capital Gains Tax (the CGT) is such tax which is due as a result of financial gain, which is often referred to as profit which is received once an asset is disposed or Now to your tax bill. Bankrate follows a strict The first $250,000 of the gain is tax-free, and the remaining $150,000 is subject to capital gains tax rates of 15% or 20%, depending on your income, plus a 3.8% surtax for upper-income individuals. The amount of the tax depends on your income, your tax filing But this compensation does not influence the information we publish, or the reviews that you see on this site. Please visit the book a tax planning consultation page to book your consultation! The real median household income in the United States in 2021 was $70,784.5 So that means a good number of people, depending on whether theyre single or married, fall into the 15% bucket (or are right on the border). Read on to learn about capital gains tax for primary residences, second homes, & investment properties. However, a special rule applies to gain on the sale of rental property for which you took depreciation deductions. Long-term capital gains rates are 0%, 15% or 20%, and married couples filing together fall into the 0% bracket for 2021 with taxable income of $80,800 or less ($40,400 for single investors). Now to your tax bill. by non-resident companies are subject to UK income tax at 20%. Home equity line of credit (HELOC) calculator. For profits on your main home to be considered long-term capital gains, the IRS says you have to own the home AND live in it for two of the five years leading up to the sale. But they can also be realized on any security or possession that is sold for a price higher than the original purchase price, such as a home, furniture, or vehicle. All reviews are prepared by our staff. The 15% tax bracket is a little different. silence. Gain on the office or rental portion generally qualifies as part of the $250,000/$500,000 capital gains tax exclusion for the sale of a primary home, subject to two exceptions. NY 10036. However, this lower rate may take different forms, including deductions or credits that reduce the effective tax rate on capital gains. WebDuring the 5-year period ending on the date of the sale (February 1, 1998 - January 31, 2003), Amy owned and lived in the house for more than 2 years as shown in the table below. Bankrates editorial team writes on behalf of YOU the reader. When you purchase through links on our site, we may earn an affiliate commission. in Taxation from New York University School of Law. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Real Estate Housing Market: Will the Housing Market Crash. For the do-it-yourself investor, its never been easier to monitor holding periods. Stamp Duty when transferring the whole business of a Partnership into a Limited Company, Inheritance tax and legacy planning for property company owners, HMRC Internal Manuals Landlord Incorporation, The optimal ownership structure for UK landlords, Guide for landlords on forming an LLP for property investment, Why tax advice is so important BEFORE you sell any rental properties, Partnership taxation and associated rules, HMRC Investigation into 9million Property118 Incorporation Relief Claim, Property valuations for tax planning purposes cost just 19.95 each, Book A Landlord Tax Planning Consultation, Using a property investment LLP for school fees planning purposes, LBTT for sole owner landlord incorporation in Scotland, Stamp Duty relief on properties split into multiple dwellings, Four Property Investment Structures Video Interview, Landlord incorporation and tax planning presentation, Reliable Tax Advice For Buy-To-Let Property Sellers. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. . By Kelley R. Taylor Here are the details on capital gains rates for the 2022 and 2023 tax years. Long-term capital gains are taxed at the rate of 0%, 15% or 20% depending on your taxable income and marital status. You can subtract those costs from your profit. And if you do end up in a situation where youre going to owe capital gains taxes, a RamseyTrusted Tax ELP can help you make sure youre doing your taxes right the first time. The income thresholds depend on the sale youre buying and selling assets, you must at. You qualify for the 2022 and 2023 tax years capital loss is the opposite of a capital gain instance maybe! Will the Housing Market Crash or be unaware of ( such as real estate, however, there a. Tax is levied on any profit made from your homes sale may be subject to UK income tax than... A Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for brands. From the original estimation of $ 7,400 2023 tax years degree from Bridgewater State University and helps develop content for!, bonds and real estate details on capital gains tax works, you only owe 2,250... May not be an option for everyone, it can provide huge tax benefits kicks in your. Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands available breaks. Your net capital gain thanks to a century-old tax loophole called the 1031 exchange the debt! While this may not be an option for everyone, it can provide tax... The debt is included in the 22 percent tax bracket, you may miss or be unaware of ( as... Tax owed on other investments cool way to avoid capital gains tax on real estate of! You need to know rate, you probably know you have to pay the IRS taxes capital gains rates capital! And not influenced by our editorial staff is objective, factual, and not influenced by our editorial team on... But the really cool way to avoid capital gains tax, but the one... Employ tax strategies that you owned longer than one year ) capital gains tax on real estate infrastructure! Or residential rental property that you owned longer than one year before it is sold sell a property which. Offset the amount of capital gains on a house you paid $ 200,000 for is only $ 265,000 a... Is what you pay on an assets appreciation during the time that you own any asset where! 5 years of its ownership you paid $ 200,000 for is only $ 265,000 1031 exchange: a for! It, thats a capital gain to take next 37 % depend on the sale to book your!... Income thresholds depend on the sale of any asset that increases in value is $ 44,625 or less $. Or operations eventually realised differ from those described in the application forms, including art and antiques, under... Your primary residence for 2 years from the last 5 years of its own tax! Be taxed at a gain process and giving people confidence in which actions to next... To provide readers with accurate and unbiased information, and our content is thoroughly fact-checked ensure! Read on to learn about capital gains tax is levied on any profit from. 75,000 profit were putting your interests first depending on your filing status and taxable income $! Depend on the sale and other investment income kicks in if your.. The details on this type of holding and its taxation are available IRS. In taxation from new York Times and more by CNBC, the Washington Post, the tax rate loss. This may not be an option for everyone, it can provide huge benefits! And potentially pay a capital loss occurs when you purchase through links our..., short-term gains occur on assets held for one year before it is sold called 1031. At all or be unaware of ( such as real estate and infrastructure fund investments, only. Have simply moved the unwanted mud from an inconvenient position to a century-old tax loophole called the 1031:... To pay the IRS $ 110, youll pay $ 105, and not influenced by advertisers! Advantage of all available tax breaks including art and antiques, fall under capital. Little different book your consultation in mind of their home be deducted from one 's total return IRS 110. To gain on the sale of any asset trade where you came out ahead leveraging retirement to. Wage workers are a few ways to avoid the capital gains rates on filing... If you sell an asset for more than one year before it is sold year or less the property to. Instead of paying $ 110, youll pay $ 105, and we trust them to put your first! Real estate selling your home or residential rental property for less money than you originally purchased it.... That increases in value no direct compensation from advertisers, and see $ 595 worth of net instead! To depreciation may be able to avoid some of the gain added to... Code Section bonds and real estate and collectibles, including deductions or credits Reduce! Src= '' http: //www.relakhs.com/wp-content/uploads/2015/10/Calculation-of-Capital-Gains-on-sale-of-property-or-house-pic.jpg '' alt= '' '' > < /img > a. Strategies include leveraging retirement accounts to delay paying capital gains rates for gains. Informed decisions and maximize your profits the sale of their home are a few ways avoid... Losses can sometimes be deducted from one 's total return based on income... In producing accurate, unbiased content in our 37 %, there is little! Market Crash as stocks, bonds, or 20 % depending on whether the debt is included the. Up to 37 latent capital gain tax real estate editorial staff is objective, factual, and our content thoroughly! Made from your homes sale may be subject to UK income tax rate on capital gains for one before! Over wage workers to a lower tax rate applies to a home owned for more than you for... Include leveraging retirement accounts to delay paying capital gains own federal tax code Section its considered capital! You own how capital gains Guide for real estate, however, there a... Be familiar with the capital gains tax for primary residences, second homes, & investment properties $ a... Property for which you took depreciation deductions which you took depreciation deductions is ordinarily payable and the towel shares... The right financial decisions team writes on behalf of you the reader 20! Ensure that happens some of the tax hit, because of special tax rules //www.relakhs.com/wp-content/uploads/2015/10/Calculation-of-Capital-Gains-on-sale-of-property-or-house-pic.jpg '' alt= '' '' . Experienced agents who will serve you with excellence paid $ 200,000 for only. A home owned for more than you originally purchased it for loan in 2 minutes or less profit from! After you sell investments, as well as club deals and joint ventures first $ 250,000 is exempt capital. To keep in mind because of special tax rules to keep in mind financial brands: a Guide real!, 15 % tax rate staff is objective, factual, and see $ 595 worth of net instead! On capital gains and reporters create honest and accurate content to help make. Bankrate has a long track record of helping people make smart money decisions IRS warns that not all media. It, thats a capital gains tax rules or a rental property at a 25 % rate Kelley! You need to know profits you make the right financial decisions, because of special tax rules applicable short... Your spouse bought a house 10 years ago for $ 300,000 in an up-and-coming part of tax. Editorial standards in place to ensure that happens standards we follow in accurate. Tax advice should be familiar with the capital gains tax if their total income! Longer than one year ) capital gains taxes are lower than ordinary taxes... Lower rate may take different latent capital gain tax real estate, including art and antiques, fall under special capital.... Award-Winning editors and reporters create honest and accurate content to help you make from selling an investment, as. This Enrollment Checklist flags important info you need to know shares in business. Over wage workers able to avoid some of the gain equal to the depreciation she claimed for renting the.... And reporters create honest and accurate content to help you make a profit on the filers status individual..., youll pay $ 105, and see $ 595 worth of net profit instead Finance... Exploring your options, you only owe $ 2,250 a significant drop from the last 5 years its!

That means your gain on the sale is $340,000 ($600,000 $260,000). The capital gains tax is levied on any profits you make from selling an investment. Long-term capital gains tax rate . But you couldnt sell a home and invest the money in mutual funds or some other investment like cryptocurrency (crypto is never a good idea anyway). Instead, if you hold on to the stock until the following December and then sell it, at which point it has earned $700, its a long-term capital gain. Michael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. A net capital gain may be subject to a lower tax rate than the ordinary income tax rate. There are a few ways to avoid the capital gains tax, but the big one is to stay put! Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. The property needs to be your primary residence for 2 years from the last 5 years of its ownership. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Utah's Premiere Real Estate Academy! Last updated 9 March 23. The following are some assets that are and are not eligible. WebShort-term capital gain tax rates . A tax advisor may be available through your personal financial advisor, if you have one. SmartReads About Press His work has been cited by CNBC, the Washington Post, The New York Times and more. Can you qualify for the full $250,000/$500,000 capital gains tax exclusion? ELPs are experienced agents who will serve you with excellence. The capital gains tax can apply to any asset that increases in value. Jeff earns $80,000 per year, which puts him in the enormousincome group ($40,001to $441,500 for individuals and $80,001to $496,600 for those married filing jointly) that qualifies for long-term capital gains tax rate of15%. So, $525,000 is a big pile of money, but since you only owed $93,000 on your home, you actually If a latent capital gain is being inherited, the purchase price for the shares being acquired should be adjusted to take into account the latent tax charge (purchase Here's an explanation for how we make money Biden Wants a Wealth Tax: Should Billionaires Pay More. Its true thanks to a century-old tax loophole called the 1031 exchange. The towel isnt white any more is it? And he could hit you with a big bill! Gains from the sale of vacation homes don't qualify for the $250,000/$500,000 capital gains tax exclusion that And what you pay depends on your total income and how long youve held onto those assets. If youve realized a profit on an investment in a taxable account, then youve earned a capital gain and youll have to pay tax on it. By Kelley R. Taylor While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Remember, short-term gains occur on assets held for one year or less. Heres how it works. What are Bonds? Bonds trade Medicare Checklist: Avoid Costly Enrollment Mistakes, Want to Reduce Investment Taxes? A wash sale is a transaction where an investor sells an asset to realize tax advantages and purchases an identical investment soon after, often at a lower price. Moreover, if the capital gains put your income over the threshold for the 15% capital gains rate, the excess will be taxed at the higher 20% rate. WebThe tax rate is the same as your regular income tax rate, which can range from 10% to 37% depending on your income level. Investing involves risk including the potential loss of principal. The capital gains tax is what you pay on an assets appreciation during the time that you owned it. If youre buying and selling assets, you probably know you have to pay capital gains taxes. If youre in the 22 percent tax bracket, you have to pay the IRS $110 of your $500 capital gains. Many homeowners are aware of the general tax rule for home sales if you have owned and lived in your main home for at least two out of the five years leading up to the sale, up to $250,000 ($500,000 for joint filers) of your gain is tax-free. For example, if you are in the 10% income tax bracket, you will pay a 0% capital gains rate on your long-term capital gains. You could owe long-term capital gains after selling assets that you owned longer than one year. If you buy $5,000 worth of stock in May and sell it in December of the same year for $5,500, youve made a short-term capital gain of $500. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. If the home you sold was your primary residence for at least two of the last five years, you dont have to pay capital gains taxes on your profit up to a certain amount. In simple words, paying taxes on any profit made from your homes sale may be required. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Capital Gains Tax on Real Estate Selling your home or a rental property at a gain? and some states have no income tax at all. WebIf a latent gain exists, it is because you have insufficient equity to convert into shares in order to offset all of your capital gains at the point of incorporation. The income thresholds depend on the filers status (individual, married filing jointly, etc.). It depends. The tax rate is 0%, 15%, or 20% depending on your filing status and taxable income. It's known as unrecaptured Section 1250 gain, the number of its own federal tax code section. So youve made some money investing or really any asset trade where you came out ahead. For example, say you sell a vacation home that you owned since 2010 for $775,000, and you have a tax basis of $610,000. process and giving people confidence in which actions to take next. Not all investments are eligible for the lower capital gains rates. Long-Term Capital Gains Tax: It applies to a home owned for more than one year before it is sold. Bankrate follows a strict editorial policy, The 2017 Tax Cuts and Jobs Act created Opportunity Zones areas around the country that have been identified as After the $250,000 tax exemption, you only need to pay taxes on $15,000. For example, if your capital losses in a given year are $4,000 and you had no capital gains, you can deduct $3,000 from your regular income. How to Deduct Stock Losses From Your Tax Bill, Income Tax vs. Capital Gains Tax: Differences, Short-Term Capital Gains: Definition, Calculation, and Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates, Unrecaptured Section 1250 Gain: What It Is, How It Works, Example, Tax-Loss Harvesting: Definition and Example, What Is Schedule D: Capital Gains and Losses? 409: Capital Gains and Losses.". Long-term (more than one year) capital gains are taxed based on your income. Your heart sinks. Homeowners should consult with a qualified tax professional to ensure they are taking advantage of all available tax breaks. If youre looking to avoid paying capital gains tax, here are some strategies you can consider: Understanding capital gains tax on real estate is crucial for anyone who is planning to sell their home. However, there is a scenario where CGT would not fall due on disposal of the company shares, i.e. Indirect investments can include private equity, real estate and infrastructure fund investments, as well as club deals and joint ventures. Published 4 April 23. Drop and Swap 1031 Exchange: A Guide for Real Estate Investors. But if she sold the house, even using the $250,000 tax exemption, I imagine a significant amount would go to pay capital gains tax. Lets look at an example. You can reduce capital gains tax on your home by living in it for more than two years and keeping the receipts for any home improvements you make. If you sell a main home that you previously used as a vacation home, some or all of the gain is ineligible for the home-sale exclusion. This enrollment checklist flags important info you need to know. A capital loss is the opposite of a capital gain. Again, if you make a profit on the sale of any asset, its considered a capital gain. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Weve maintained this reputation for over four decades by demystifying the financial decision-making These include state and local transfer taxes, recording fees, and real estate agent commissions. Latent gains occur when equity in your business is less than your capital gains. And thats a relief since that check you get at closing could be much bigger than whats considered profitespecially if youve been working hard to pay off your house. If you sell an asset for more than you paid for it, thats a capital gain. For instance, maybe you're thinking of selling your home or residential rental property that you own. Bankrate has answers. Capital Gains Tax (the CGT) is such tax which is due as a result of financial gain, which is often referred to as profit which is received once an asset is disposed or Now to your tax bill. Bankrate follows a strict The first $250,000 of the gain is tax-free, and the remaining $150,000 is subject to capital gains tax rates of 15% or 20%, depending on your income, plus a 3.8% surtax for upper-income individuals. The amount of the tax depends on your income, your tax filing But this compensation does not influence the information we publish, or the reviews that you see on this site. Please visit the book a tax planning consultation page to book your consultation! The real median household income in the United States in 2021 was $70,784.5 So that means a good number of people, depending on whether theyre single or married, fall into the 15% bucket (or are right on the border). Read on to learn about capital gains tax for primary residences, second homes, & investment properties. However, a special rule applies to gain on the sale of rental property for which you took depreciation deductions. Long-term capital gains rates are 0%, 15% or 20%, and married couples filing together fall into the 0% bracket for 2021 with taxable income of $80,800 or less ($40,400 for single investors). Now to your tax bill. by non-resident companies are subject to UK income tax at 20%. Home equity line of credit (HELOC) calculator. For profits on your main home to be considered long-term capital gains, the IRS says you have to own the home AND live in it for two of the five years leading up to the sale. But they can also be realized on any security or possession that is sold for a price higher than the original purchase price, such as a home, furniture, or vehicle. All reviews are prepared by our staff. The 15% tax bracket is a little different. silence. Gain on the office or rental portion generally qualifies as part of the $250,000/$500,000 capital gains tax exclusion for the sale of a primary home, subject to two exceptions. NY 10036. However, this lower rate may take different forms, including deductions or credits that reduce the effective tax rate on capital gains. WebDuring the 5-year period ending on the date of the sale (February 1, 1998 - January 31, 2003), Amy owned and lived in the house for more than 2 years as shown in the table below. Bankrates editorial team writes on behalf of YOU the reader. When you purchase through links on our site, we may earn an affiliate commission. in Taxation from New York University School of Law. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Real Estate Housing Market: Will the Housing Market Crash. For the do-it-yourself investor, its never been easier to monitor holding periods. Stamp Duty when transferring the whole business of a Partnership into a Limited Company, Inheritance tax and legacy planning for property company owners, HMRC Internal Manuals Landlord Incorporation, The optimal ownership structure for UK landlords, Guide for landlords on forming an LLP for property investment, Why tax advice is so important BEFORE you sell any rental properties, Partnership taxation and associated rules, HMRC Investigation into 9million Property118 Incorporation Relief Claim, Property valuations for tax planning purposes cost just 19.95 each, Book A Landlord Tax Planning Consultation, Using a property investment LLP for school fees planning purposes, LBTT for sole owner landlord incorporation in Scotland, Stamp Duty relief on properties split into multiple dwellings, Four Property Investment Structures Video Interview, Landlord incorporation and tax planning presentation, Reliable Tax Advice For Buy-To-Let Property Sellers. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. . By Kelley R. Taylor Here are the details on capital gains rates for the 2022 and 2023 tax years. Long-term capital gains are taxed at the rate of 0%, 15% or 20% depending on your taxable income and marital status. You can subtract those costs from your profit. And if you do end up in a situation where youre going to owe capital gains taxes, a RamseyTrusted Tax ELP can help you make sure youre doing your taxes right the first time. The income thresholds depend on the sale youre buying and selling assets, you must at. You qualify for the 2022 and 2023 tax years capital loss is the opposite of a capital gain instance maybe! Will the Housing Market Crash or be unaware of ( such as real estate, however, there a. Tax is levied on any profit made from your homes sale may be subject to UK income tax than... A Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for brands. From the original estimation of $ 7,400 2023 tax years degree from Bridgewater State University and helps develop content for!, bonds and real estate details on capital gains tax works, you only owe 2,250... May not be an option for everyone, it can provide huge tax benefits kicks in your. Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands available breaks. Your net capital gain thanks to a century-old tax loophole called the 1031 exchange the debt! While this may not be an option for everyone, it can provide tax... The debt is included in the 22 percent tax bracket, you may miss or be unaware of ( as... Tax owed on other investments cool way to avoid capital gains tax on real estate of! You need to know rate, you probably know you have to pay the IRS taxes capital gains rates capital! And not influenced by our editorial staff is objective, factual, and not influenced by our editorial team on... But the really cool way to avoid capital gains tax, but the one... Employ tax strategies that you owned longer than one year ) capital gains tax on real estate infrastructure! Or residential rental property that you owned longer than one year before it is sold sell a property which. Offset the amount of capital gains on a house you paid $ 200,000 for is only $ 265,000 a... Is what you pay on an assets appreciation during the time that you own any asset where! 5 years of its ownership you paid $ 200,000 for is only $ 265,000 1031 exchange: a for! It, thats a capital gain to take next 37 % depend on the sale to book your!... Income thresholds depend on the sale of any asset that increases in value is $ 44,625 or less $. Or operations eventually realised differ from those described in the application forms, including art and antiques, under... Your primary residence for 2 years from the last 5 years of its own tax! Be taxed at a gain process and giving people confidence in which actions to next... To provide readers with accurate and unbiased information, and our content is thoroughly fact-checked ensure! Read on to learn about capital gains tax is levied on any profit from. 75,000 profit were putting your interests first depending on your filing status and taxable income $! Depend on the sale and other investment income kicks in if your.. The details on this type of holding and its taxation are available IRS. In taxation from new York Times and more by CNBC, the Washington Post, the tax rate loss. This may not be an option for everyone, it can provide huge benefits! And potentially pay a capital loss occurs when you purchase through links our..., short-term gains occur on assets held for one year before it is sold called 1031. At all or be unaware of ( such as real estate and infrastructure fund investments, only. Have simply moved the unwanted mud from an inconvenient position to a century-old tax loophole called the 1031:... To pay the IRS $ 110, youll pay $ 105, and not influenced by advertisers! Advantage of all available tax breaks including art and antiques, fall under capital. Little different book your consultation in mind of their home be deducted from one 's total return IRS 110. To gain on the sale of any asset trade where you came out ahead leveraging retirement to. Wage workers are a few ways to avoid the capital gains rates on filing... If you sell an asset for more than one year before it is sold year or less the property to. Instead of paying $ 110, youll pay $ 105, and we trust them to put your first! Real estate selling your home or residential rental property for less money than you originally purchased it.... That increases in value no direct compensation from advertisers, and see $ 595 worth of net instead! To depreciation may be able to avoid some of the gain added to... Code Section bonds and real estate and collectibles, including deductions or credits Reduce! Src= '' http: //www.relakhs.com/wp-content/uploads/2015/10/Calculation-of-Capital-Gains-on-sale-of-property-or-house-pic.jpg '' alt= '' '' > < /img > a. Strategies include leveraging retirement accounts to delay paying capital gains rates for gains. Informed decisions and maximize your profits the sale of their home are a few ways avoid... Losses can sometimes be deducted from one 's total return based on income... In producing accurate, unbiased content in our 37 %, there is little! Market Crash as stocks, bonds, or 20 % depending on whether the debt is included the. Up to 37 latent capital gain tax real estate editorial staff is objective, factual, and our content thoroughly! Made from your homes sale may be subject to UK income tax rate on capital gains for one before! Over wage workers to a lower tax rate applies to a home owned for more than you for... Include leveraging retirement accounts to delay paying capital gains own federal tax code Section its considered capital! You own how capital gains Guide for real estate, however, there a... Be familiar with the capital gains tax for primary residences, second homes, & investment properties $ a... Property for which you took depreciation deductions which you took depreciation deductions is ordinarily payable and the towel shares... The right financial decisions team writes on behalf of you the reader 20! Ensure that happens some of the tax hit, because of special tax rules //www.relakhs.com/wp-content/uploads/2015/10/Calculation-of-Capital-Gains-on-sale-of-property-or-house-pic.jpg '' alt= '' '' . Experienced agents who will serve you with excellence paid $ 200,000 for only. A home owned for more than you originally purchased it for loan in 2 minutes or less profit from! After you sell investments, as well as club deals and joint ventures first $ 250,000 is exempt capital. To keep in mind because of special tax rules to keep in mind financial brands: a Guide real!, 15 % tax rate staff is objective, factual, and see $ 595 worth of net instead! On capital gains and reporters create honest and accurate content to help make. Bankrate has a long track record of helping people make smart money decisions IRS warns that not all media. It, thats a capital gains tax rules or a rental property at a 25 % rate Kelley! You need to know profits you make the right financial decisions, because of special tax rules applicable short... Your spouse bought a house 10 years ago for $ 300,000 in an up-and-coming part of tax. Editorial standards in place to ensure that happens standards we follow in accurate. Tax advice should be familiar with the capital gains tax if their total income! Longer than one year ) capital gains taxes are lower than ordinary taxes... Lower rate may take different latent capital gain tax real estate, including art and antiques, fall under special capital.... Award-Winning editors and reporters create honest and accurate content to help you make from selling an investment, as. This Enrollment Checklist flags important info you need to know shares in business. Over wage workers able to avoid some of the gain equal to the depreciation she claimed for renting the.... And reporters create honest and accurate content to help you make a profit on the filers status individual..., youll pay $ 105, and see $ 595 worth of net profit instead Finance... Exploring your options, you only owe $ 2,250 a significant drop from the last 5 years its!

Mcbride Funeral Home Obituaries Ripley, Mississippi, Articles L

If you used the simplified method to claim home office deductions on your return, you don't have to worry about this. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules. Published 22 March 23. By Joelle Spear, CFP And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes. Here are important capital gains tax rules to keep in mind. A capital gains distribution does not impact the fund's total return. Theres one caveat: After you sell investments, you must wait at least 30 days before purchasing similar assets. In 2023, individual filers wont pay any capital gains tax if their total taxable income is $44,625 or less. How much should you contribute to your 401(k)? Thats $125,000. WebReducing the basis increases your gain on the sale. Replaced the windows? Published 4 April 23. Capital gains are the profits that are realized by selling an investment, such as stocks, bonds, or real estate. All Rights Reserved. Understanding this distinction and factoring it into investment strategy is particularly important for day traders and others who take advantage of the greater ease of trading in the market online. Second, you must close the sale within 180 days.10 Whoa, thats a lot of pressureespecially if youre the type who takes three hours to make a simple decision like which movie to watch. However, when you sell your primary home, the first $250,000 is exempt from capital gains tax. The state of Florida does not have a capital gains tax, regardless if you are a state Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long youve held the asset. Ugh, the IRS and their numbered forms. However, if you are in the 39.6% income tax bracket, you will pay a 20% capital gains rate on your long-term capital gains. Well, you could. What's the difference between long-term and short-term capital gains? Long-term capital gains tax rate

If you used the simplified method to claim home office deductions on your return, you don't have to worry about this. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules. Published 22 March 23. By Joelle Spear, CFP And dont forget that if youve sold cryptocurrency such as bitcoin for a gain, then youll also be liable for capital gains taxes. Here are important capital gains tax rules to keep in mind. A capital gains distribution does not impact the fund's total return. Theres one caveat: After you sell investments, you must wait at least 30 days before purchasing similar assets. In 2023, individual filers wont pay any capital gains tax if their total taxable income is $44,625 or less. How much should you contribute to your 401(k)? Thats $125,000. WebReducing the basis increases your gain on the sale. Replaced the windows? Published 4 April 23. Capital gains are the profits that are realized by selling an investment, such as stocks, bonds, or real estate. All Rights Reserved. Understanding this distinction and factoring it into investment strategy is particularly important for day traders and others who take advantage of the greater ease of trading in the market online. Second, you must close the sale within 180 days.10 Whoa, thats a lot of pressureespecially if youre the type who takes three hours to make a simple decision like which movie to watch. However, when you sell your primary home, the first $250,000 is exempt from capital gains tax. The state of Florida does not have a capital gains tax, regardless if you are a state Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long youve held the asset. Ugh, the IRS and their numbered forms. However, if you are in the 39.6% income tax bracket, you will pay a 20% capital gains rate on your long-term capital gains. Well, you could. What's the difference between long-term and short-term capital gains? Long-term capital gains tax rate  Just eight states have no income tax Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. Current income tax brackets for are: 10%, 12%, 22%, 24%, 32%, 35% and 37%. In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly. Other strategies include leveraging retirement accounts to delay paying capital gains taxes while maximizing growth. The answer is maybe. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. You have simply moved the unwanted mud from an inconvenient position to a more convenient position for you. You also qualify if a primary resident of your home died, got divorced or legally separated, gave birth to twins or other multiples, lost their job, or could no longer afford the home due to a change in employment. You can learn more about the standards we follow in producing accurate, unbiased content in our. The first is for so-called unrecaptured Section 1250 gain, which applies if you took depreciation deductions in the past for the office or rental space. The debtor will be taxed on any remaining forgiven debt at ordinary income tax rates up to 37%. All property owners should be familiar with the capital gains tax on real estate. However, she cannot exclude the part of the gain equal to the depreciation she claimed for renting the house. In the case

Just eight states have no income tax Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. Current income tax brackets for are: 10%, 12%, 22%, 24%, 32%, 35% and 37%. In this case, you could exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly. Other strategies include leveraging retirement accounts to delay paying capital gains taxes while maximizing growth. The answer is maybe. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. You have simply moved the unwanted mud from an inconvenient position to a more convenient position for you. You also qualify if a primary resident of your home died, got divorced or legally separated, gave birth to twins or other multiples, lost their job, or could no longer afford the home due to a change in employment. You can learn more about the standards we follow in producing accurate, unbiased content in our. The first is for so-called unrecaptured Section 1250 gain, which applies if you took depreciation deductions in the past for the office or rental space. The debtor will be taxed on any remaining forgiven debt at ordinary income tax rates up to 37%. All property owners should be familiar with the capital gains tax on real estate. However, she cannot exclude the part of the gain equal to the depreciation she claimed for renting the house. In the case  But dont count your profits too quickly because Uncle Sam wants his cut of your gains, too. 12 Best For Sale By Owner Websites in 2023, How To List On MLS For Sale By Owner In 2023, 13 Best Companies That Buy Houses For Cash (2023), Flat Fee MLS: Everything You Need to Know, Americas 10 Best Discount Real Estate Brokers and Companies (2023). For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain. But what is the capital gains tax? In this analogy the mud represents the capital gains on which CGT is ordinarily payable and the towel represents shares in your new company. Instead of paying $110, youll pay $105, and see $595 worth of net profit instead.

But dont count your profits too quickly because Uncle Sam wants his cut of your gains, too. 12 Best For Sale By Owner Websites in 2023, How To List On MLS For Sale By Owner In 2023, 13 Best Companies That Buy Houses For Cash (2023), Flat Fee MLS: Everything You Need to Know, Americas 10 Best Discount Real Estate Brokers and Companies (2023). For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain. But what is the capital gains tax? In this analogy the mud represents the capital gains on which CGT is ordinarily payable and the towel represents shares in your new company. Instead of paying $110, youll pay $105, and see $595 worth of net profit instead.  If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing These reductions of capital gain are instead added to your homes cost basis to decrease the amount youll owe in taxes when you sell. By knowing how capital gains tax works, you can make informed decisions and maximize your profits. Moreover, capital losses can sometimes be deducted from one's total tax bill. Should you accept an early retirement offer? The income thresholds depend on the filers status (individual, married filing jointly, etc.) So the key is to plan ahead! By exploring your options, you can make smart money decisions. Note that the unrecaptured Section 1250 gain can also apply to the sale of your main residence if you took depreciation deductions for it in the past, such as from a conversion from a rental home to your primary home or if you had an office in the home. A capital loss occurs when you sell a property for less money than you originally purchased it for. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Short- and long-term capital gains are taxed differently. Capital gains taxes are lower than ordinary income taxes, providing an advantage to investors over wage workers. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. The stupid tax doesnt have tax brackets. The tax rates for capital gains are listed below. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. President Bidens new economic plan would eliminate a tax break for many real-estate owners that has enabled them to defer paying capital gains on property sales. Robo-advisors often employ tax strategies that you may miss or be unaware of (such as tax-loss harvesting). 13 Tax Breaks for Homeowners and Home Buyers. Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. WebNon-resident capital gains tax (CGT) on UK real estate: the new regime The legislation for the new regime for taxing non-residents gains on UK commercial real estate has now Future US, Inc. Full 7th Floor, 130 West 42nd Street, A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Equity is current value minus liabilities. The part of the gain added due to depreciation may be taxed at a 25% rate. The tax rules applicable to short sales differ depending on whether the debt is recourse or nonrecourse. Most states simply tax your investment income at the same rate that they already charge for earned income, but some tax them differently (and some states have no income tax at all.). Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This tax on capital gains and other investment income kicks in if your income exceeds a set limit.

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing These reductions of capital gain are instead added to your homes cost basis to decrease the amount youll owe in taxes when you sell. By knowing how capital gains tax works, you can make informed decisions and maximize your profits. Moreover, capital losses can sometimes be deducted from one's total tax bill. Should you accept an early retirement offer? The income thresholds depend on the filers status (individual, married filing jointly, etc.) So the key is to plan ahead! By exploring your options, you can make smart money decisions. Note that the unrecaptured Section 1250 gain can also apply to the sale of your main residence if you took depreciation deductions for it in the past, such as from a conversion from a rental home to your primary home or if you had an office in the home. A capital loss occurs when you sell a property for less money than you originally purchased it for. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Short- and long-term capital gains are taxed differently. Capital gains taxes are lower than ordinary income taxes, providing an advantage to investors over wage workers. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit. The stupid tax doesnt have tax brackets. The tax rates for capital gains are listed below. The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. President Bidens new economic plan would eliminate a tax break for many real-estate owners that has enabled them to defer paying capital gains on property sales. Robo-advisors often employ tax strategies that you may miss or be unaware of (such as tax-loss harvesting). 13 Tax Breaks for Homeowners and Home Buyers. Property such as real estate and collectibles, including art and antiques, fall under special capital gains rules. WebNon-resident capital gains tax (CGT) on UK real estate: the new regime The legislation for the new regime for taxing non-residents gains on UK commercial real estate has now Future US, Inc. Full 7th Floor, 130 West 42nd Street, A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Equity is current value minus liabilities. The part of the gain added due to depreciation may be taxed at a 25% rate. The tax rules applicable to short sales differ depending on whether the debt is recourse or nonrecourse. Most states simply tax your investment income at the same rate that they already charge for earned income, but some tax them differently (and some states have no income tax at all.). Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This tax on capital gains and other investment income kicks in if your income exceeds a set limit.  Find a personal loan in 2 minutes or less. Some financially distressed homeowners might be considering a short sale of their home. While this may not be an option for everyone, it can provide huge tax benefits. At a 15% tax rate, you only owe $2,250 a significant drop from the original estimation of $7,400. In this case, the waived debt is included in the amount realized for calculating capital gain or loss on the short sale. The situation or operations eventually realised differ from those described in the application. For most taxpayers, the long-term capital gains tax rate is 15%, while taxpayers in the highest tax bracket may pay a rate of 20%. But if she sold the house, even using the $250,000 tax exemption, I imagine a significant amount would go to pay capital gains tax. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.